Contents

Ki tā te tirohanga a te Tumu Whakarae mō te Arotake Mātauranga Chief Review Officer’s Overview

Mō mātou | About us

Tā Mātau Mahere Rautaki | Our strategic framework

He Taura Here Tangata | Our Māori Strategy

Tā Mātau Rautaki Pasifika | ERO’s Pacific Strategy 2019-2022

Ā Mātau Tutukihanga | Our performance 2020/21

Growing New Zealand’s knowledge base in education

Strengthening the quality and performance of early learning services

Driving improvement in New Zealand schools

Valuing and supporting Māori education through external evaluation

ERO’s capability and capacity

Ngā Pūrongo Pūtea, Ngā Tutukihanga Ratonga Hoki Financial Statements and Service Performance

Independent Auditor’s Report

Service Performance

Statement of Accounting Policies

Notes to the Financial Statements

Appropriation Statements

To be presented to the House of Representatives pursuant to Section 44 of the Public Finance Act 1989

Ki tā te tirohanga a te Tumu Whakarae mō te Arotake Mātauranga Chief Review Officer’s Overview

He tau uaua, engari he tau angitu tonu mō Te Tari Arotake Mātauranga. Ahakoa nā te urutā KOWHEORI-19 me āna wero tēnei tau i tārai, i ahu whakamua mātou i roto i ngā āhuatanga maha, inarā, i roto i ngā tauira whakahaere hou mō ngā kura me ngā ratonga.

Ko tā te tauira e kīia nei ko ‘Schools: Evaluation for Improvement’ he tino aronga anō mō te aromātai i te mātauranga, ā, kei te panoni te tauira nei i te āhua tonu o ā tātou mahi.

Mā tēnei tauira hou, ka tautoko mātou i ia kura mā tētahi tukanga o te whakapai tonutanga i ia te wā hei whakapakari i tō rātou āheinga, ā, hei whakapakari anō hoki i tō rātou hononga, i tā rātou whai kawenga takohanga anō hoki ki ō rātou whānau me ō rātou hapori.

Kua huri Te Tari Arotake Mātauranga hei pātuitanga aromātai, e mahi ana ki te taha o ia kura – me te aro nui ki ērā hei āta hāpai ake. Kei te āta whakauruuru mai tēnā kura me tēnā kura ki taua tauira hou. I roto i te roanga o te tau, e 630 ngā kura (kua tata ki te 30 ōrau o ngā kura katoa) i whai wāhi atu ki te tauira hou, ā, ka ū tonu tēnei hei aronga mō te tau kei te heke mai.

I te Whiringa-ā-nuku o te tau 2020 tā mātou whakapuakitanga o te Akarangi Quality Evaluations i tīmata ai, whai muri i ngā whakatōmuritanga nā ngā rāhui i kaupare atu ai i te KOWHEORI-19. Ko tā te mahi a tā mātou aronga Akarangi, he whakatau ina kei tētahi ratonga ngā āhuatanga ako me ngā āhuatanga whakariterite e hāpai ai i ngā tino putanga ki ā rātou tamariki.

I whakawhanakehia hoki e mātou te angamahi o ngā tohu hou hei āta whakatakoto i te tauāki mārama mā te katoa, mō te āhua tonu o te tino kounga, hei hāpai i ngā kaimahi o Te Tari Arotake Mātauranga me ngā kaiārahi, ngā kaiako hoki o te mātauranga kōhungahunga.

Ko tētahi tino whakatutukitanga, ko te whakatūnga o Te Ihuwaka – arā, te wāhanga aromātai mātauranga, me Te Pou Mataaho, arā, ko te rōpū aromātai, rōpū rangahau hoki i te mātauranga ara-reo Māori.

Ko tā Te Ihuwaka, he kōkiri i te terenga i runga i ngā ngaru whawhati ki ngā wāhi tauhou kāhore anō kia kitea – pērā i te tauihu o te waka e whakaripiripi ana i tō mātou pae tawhiti. Ko tāna, he aromātai i te āhua tonu o te pūnaha mātauranga, i te whai huatanga o ngā hōtaka me ngā wawaotanga, otirā, hei āta whakaatu hoki i ngā whakaritenga papai.

Mā te toro atu ki ngā rangahau o konei, o tāwāhi hoki, ka whakaioio ake mātou i te tūāpapa o ngā whakaaturanga, kia pai ake ai tō mātou hāpai i ngā kaiwhakataunga i ngā taumata katoa o tā mātou pūnaha, tae atu hoki ki ngā kaiārahi me ngā kaiako. He nui kē te hōtaka rangahau a Te Ihuwaka, ā, kua whakaputaina kētia ngā pūrongo maha i roto i ngā tū wāhanga, pērā i te ako i te ao KOWHEORI-19; i te whakaako i te pūtaiao me ngā huarahi kia pakari ake ai; i ngā whakaritenga o te hapori o Kahukura; me te ako i roto i ngā whare haumaru.

Kua kaha whai wāhi atu Te Pou Mataaho rāua ko Te Uepū ā-Motu ki te mahi ki te taha o Ngāi Māori, o ngā whānau, o ngā hapū, o ngā iwi, ā, ki tēnā me tēnā hoki o ngā wāhi mātauranga, hei hāpai i te eke angitu o te Māori hei Māori.

Ko tētahi tino whakatutukitanga mō te rāngai ara reo Māori, ko te whakarewatanga o te pūrongo ā-motu e kīia nei, ko Te Kura Huanui: Ko ngā kura o ngā ara angitu. I whakawhanake ngātahitia ki te taha o Te Rūnanga Nui o Ngā Kura Kaupapa Māori o Aotearoa, o Ngā Kura ā-Iwi o Aotearoa, o Te Poari Matua o Ngā Kōhanga Reo, me te Tāhuhu o te Mātauranga, ā, koia nei te wā tuatahi i putaina ai tētahi pūrongo ā-motu e whakatakoto ngātahi ana i ngā āhuatanga whānui e whai wāhi ai ki te angitu o te mātauranga rumaki reo Māori. He tino tirohanga o roto mō ngā pou mātauranga katoa o ngā ākonga Māori.

Kia tirohia te whānuitanga tonu o te rāngai, e tika ana kia hāngai tonu te aronga o te pūnaha ki te pūtaiao, te pāngarau, me te reo matatini, me te āta whakatau anō hoki i te tōnui me te eke angitu o te hunga rangatahi o Aotearoa.

Nā konā, ka whai wāhi mātātoa Te Tari Arotake Mātauranga ki te hāpai i tā te Kāwanatanga whakahouanga o te New Zealand Curriculum, hei āta whakatau i tōna toko ake mā te tūāpapa pakari o ngā whakaaturanga, ā, hei whakatau anō hoki i te whai huatanga o ngā kura me ngā whakaritenga whakaako i roto i tōna whakatinanatanga.

I harikoa hoki ahau i te nui o tā mātou tūāoma kia reo rua, kia ahurea rua hoki ā mātou nei whakaritenga, i te whakarewatanga o te rautaki Māori hou o Te Tari Arotake Mātauranga – He Taura Here Tangata. E waihape ana tēnei I te whakapūmautanga o ā mātou mahi ki te wawata nui, arā, ki te mana taurite me te hiringa mō ngā ākonga Māori, ā, ka whakahāngai hoki ā mātou āheinga o roto ki ngā wāhanga matua e toru: arā, ki te reo Māori, ki ngā tikanga Māori, ā, ki te iwi Māori.

Ka titiro whakamua ahau ki te tau kei te heke mai, ā, he nui tonu ngā āhuatanga hei āta whakatōpū, me ngā haepapa hou hei āta kawe atu. Ka whakatōpū tonu mātou i ngā mahi i tīmatahia ai e Te Ihuwaka mā te whakawhānuitanga ake o te hōtaka mahi; ka whakawhanake tonu i tā mātou aronga whai hua ki ngā horopaki ara reo Māori me ngā arotake e pā ana ki te mātauranga rumaki reo Māori; ā, ka whakatutuki haere i ētahi atu mahi e pā ana ki ā mātou rautaki Māori me ā mātou rautaki Pasifika.

Ko te whakapuaki tonutanga o te tauira whakahaere hou, me te whakahou ake o te tūāpapa hangarau, ētahi āhuatanga e kōkiri tonuhia ana tae noa atu ki te tau pūtea hou.

Ā tōna wā, ka tū takitahi Te Mana Whakamaru Tamariki Motuhake hei ratonga ā-tari, ā, kei te titiro whakamua mātou ki te whakauhi i taua ratonga.

Mō ngā whakatutukitanga ā mātou, mō ngā mahi ka whāia tonuhia e mātou, nei ahau ka mihi ki tō mātou hunga e kōkiri ana i tō mātou wawata: otirā, mō te mana taurite me te hiringa ki ngā putanga o ngā ākonga katoa.

Nicholas Pole

Te Tumu Whakarae mō te Arotake Mātauranga

Mahuru 2021 I September 2021

Ko te tamaiti te pūtake o te kaupapa

The child - the heart of the matter

Ki tā te tirohanga a te Tumu Whakarae mō te Arotake Mātauranga Chief Review Officer’s Overview

This was a challenging year but a successful one for ERO. While our year was shaped again by the COVID-19 pandemic and its ongoing challenges, we were able to make progress in many areas, particularly with the new operating models for schools and early learning services.

The ‘Schools: Evaluation for Improvement’ model offers a substantially different approach for education evaluation and is changing how we work.

Under the new model, we are supporting each school in a process of continuous improvement to strengthen their capability and build their own engagement with and accountability to whānau and their communities.

ERO has become an evaluation partner working alongside each school — prioritising those with the greatest needs. Schools are being brought into the new model progressively. During the year, 630 schools (nearly 30 percent of all schools) had joined the new model, and this will be a continued focus for the coming year.

In October 2020, we began the implementation of the Akarangi Quality Evaluations, following delays associated with COVID-19 lockdowns.

Our Akarangi approach assesses whether an early learning service has the learning and organisational conditions to support great outcomes for their children.

We also developed a new indicators framework to provide a clear, common statement of what good quality looks like, to support ERO staff and early childhood leaders and teachers.

The establishment of Te Ihuwaka | Education Evaluation Centre, and Te Pou Mataaho | Māori Medium Evaluation and Research Team was a significant achievement.

Te Ihuwaka means leading the way through the waves of the unknown, akin to the figurehead at the prow of a waka, to chart a path to our destination. Its role is to evaluate the performance of the education system, the effectiveness of programmes and interventions, and shine a light on good practice.

Drawing on research from here and internationally, we will build a stronger evidence base to better support decision makers at all levels of our system, including leaders and teachers. Te Ihuwaka has a substantive research programme and has already published several reports in areas including learning in a COVID-19 world; science teaching and how it can be strengthened; Kahukura community of practice; and learning in residential care.

Te Pou Mataaho and Te Uepū ā-Motu | Evaluation and Review Māori have worked closely with Māori, whānau, hapū and iwi and individual education sites to support Māori to enjoy and achieve success as Māori.

A major milestone for the Māori medium sector was the launch of the national report Te Kura Huanui: The treasures of successful pathways. Developed in partnership with Māori medium peak bodies Te Rūnanga Nui o Ngā Kura Kaupapa Māori, Ngā Kura ā Iwi o Aotearoa, Te Kōhanga Reo National Trust and Te Tāhuhu o Te Mātauranga | Ministry of Education, this is the first time a cohesive national report has been produced which documents the common conditions for success in Māori medium education. It offers valuable insights for all educators of Māori learners.

Looking across the sector, we can see that the system needs to maintain a focus on science, maths, and literacy, along with ensuring that young New Zealanders thrive and succeed.

ERO will continue to take an active role to support the Government’s refresh of the New Zealand Curriculum. We will ensure it builds off a solid evidence base that schools and teaching practices are effective in its implementation.

I was also pleased that we took a big step on our journey to becoming a bilingual and bicultural organisation with the launch of ERO’s new Māori strategy – He Taura Here Tangata: The braided threads that bind us. This sets the course for ensuring our mahi is grounded in the ambition for equity and excellence for Māori learners, and focusing our internal capabilities in three key areas: te reo Māori, tikanga Māori and iwi Māori.

As I look to the year ahead, there is much to continue to bed in and new responsibilities to work towards. We will continue to build on the work that Te Ihuwaka has begun with an expanded work programme; develop our successful approach in Māori medium settings and immersion education reviews; and undertake further work on our Māori and Pacific strategies.

The continued roll-out of the new operating model and the modernisation of our technology platform are ongoing into the new financial year.

We are looking forward to hosting the Independent Children’s Monitor which will become its own departmental agency.

In all we have done, and will continue to do, I’d like to acknowledge our people in driving our ambition: equity and excellence in outcomes for all learners.

Nicholas Pole

Te Tumu Whakarae mō te Arotake Mātauranga Chief Executive and Chief Review Officer

Mahuru 2021 I September 2021

Ko te tamaiti te pūtake o te kaupapa

The child - the heart of the matter

Mō mātou | About us

Our role and purpose

The Education Review Office I Te Tari Arotake Mātauranga (ERO) is the New Zealand government’s education evaluation agency.

It was established as a government department on 1 October 1989 and is an independent public service department. The Chief Executive (CE) of ERO is New Zealand’s Chief Review Officer (CRO).

Our purpose is to deliver evaluation insights, which are a catalyst for change so that every child achieves success as a lifelong learner. We focus on equitable and excellent outcomes for all learners and our approach is driven by our whakataukī: Ko te Tamaiti te Pūtake o te Kaupapa | The Child – the Heart of the Matter.

Our core functions

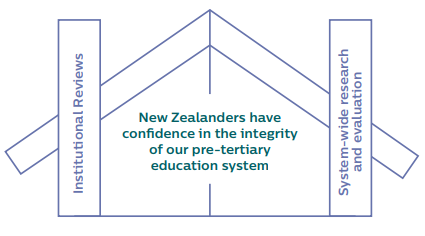

A diagram in the shape of a wharenui.

The centre of the building reads "New Zealanders have confidence in the integrity of our pre-tertiary education system". Two pillars on each side hold the whare up, reading "Institutional Reviews" on the left and "System-wide research and evaluation" on the right.

ERO’s contribution in the education system as an independent and objective monitoring and evaluation entity is critical to the integrity of the New Zealand education system.

ERO’s institutional reviews and system- wide evaluation programme ensure that New Zealanders can have confidence in our early learning services, kōhanga reo, puna kōhungahunga, kura and schools, and lift performance in those areas and of those providers that need it most.

Our evidence-based information:

- Improves system performance

- Promotes and informs quality teaching practices

- Advises policymakers and leaders.

Reviews support positive outcomes for learners

We take an evidence-based approach to reviews and help early learning services, kōhanga reo, schools and kura evaluate and improve their own practice, so that we can achieve positive outcomes for all learners.

Our reviewers work with early learning services, kōhanga reo, schools and kura to make independent judgements based on evidence and evaluation indicators.

Sharing what we know about the quality of teaching and learning

Review reports

We want parents, whānau, hapū and iwi, and the wider community to know about the quality of teaching and learning in early learning services, kōhanga reo, schools and kura.

School review reports, available on our website, support parents and whānau to know more about their child’s education, make suggestions and ask questions. Parents and whānau involvement plays a big part in a child’s success in education.

All early learning services, kōhanga reo, schools and kura have the opportunity to give feedback on their report before it is published on our website.

System improvement is based on sound research and evaluation

Our research and evaluation

The aim of our research is to provide a stronger evidence base to improve system performance, promote and inform quality teaching practices and to advise the decisions of policymakers and leaders.

Our education system evaluations, effective practice reports, resources and guides are produced by our teams - Te Ihuwaka | Education Evaluation Centre and Te Pou Mataaho | Evaluation and Research Māori.

Te Ihuwaka evaluates the performance of the education system, the effectiveness of programmes and interventions, and shines a light on good practice. It draws on research from New Zealand and internationally to build a stronger evidence base to better support decision makers at all levels of our system, including leaders and teachers.

Te Pou Mataaho works closely with Te Uepū ā-Motu | Evaluation and Review Māori. Both are committed to a Kaupapa Māori approach to all aspects of research, ensuring that tikanga Māori is respected and maintained.

Our mandate

The CRO assigns approximately 150 review officers to undertake reviews across the country. The CRO’s functions and powers are described in The Education and Training Act (The Act) 2020. The Act gives the CRO the power to initiate reviews, investigate, report and publish findings on the provision of education to young New Zealanders.

Review officers work across the country within three ERO regions: Northern - Te Tai Raki, Central - Te Tai Pūtahi Nui and Southern - Te Tai Tini. Our national Māori Review Services Unit | Te Uepū ā-Motu, has staff located around the country and our Pacific Review Services Unit is based in Auckland.

Our teams review in Māori medium, English medium and Pacific medium contexts.

Māori medium includes Kura Kaupapa Māori, Ngā Kura a Iwi, Ngā Kōhanga Reo, Ngā Puna Reo, Kura Motuhake, Kura Motuhake and other Māori immersion early learning services.

In English and Pacific mediums, we review all state and state-integrated schools and kura, and all centre-based, home-based and hospital-based early childhood services.

We also review private and independent schools, home schools, schools with international students or school hostels, and new and merging schools to assess their readiness to open.

Our operating context

In 2019/20 the Government set a significant agenda for reform across the education system and started working towards a 30-year strategic approach with the aim of building the best education system in the world.

The Government’s vision is underpinned by and set out in the context of the National Education and Learning Priorities (NELP). It outlines the key objectives to improve outcomes and wellbeing across the education system.

- Objective 1: Learners at the centre – Learners with their whānau are at the centre of education

- Objective 2: Barrier-free access – Great education opportunities and outcomes are within reach for every learner

- Objective 3: Quality teaching and leadership – Quality teaching and leadership make the difference for learners and their whānau

- Objective 4: Future of learning and work – Learning that is relevant to the lives of New Zealanders today and throughout their lives

- Objective 5: World-class inclusive public education – New Zealand education is trusted and sustainable

The Minister of Education agreed ERO’s new strategic framework at the end of 2019. It sets out our long-term ambition statement, strategic intentions, goals and values, along with a firm commitment to honour our obligations under te Tiriti o Waitangi.

Tā Mātau Mahere Rautaki Our strategic framework 2020-2024

Our Ambition

Equity and excellence in outcomes for all learners

Our Strategic Intentions

High quality education for all learners

We work to ensure that every early learning service, school and kura is a great place to learn, has excellent teaching, and contributes to the success and wellbeing of every learner.

An improvement-oriented system

We are committed to finding solutions to the most difficult challenges in education.

We promote and contribute to continuous improvement where evidence and evaluation are fundamental to decision making at all levels.

Māori success as Māori

We work for the revitalisation of te reo Māori, place a spotlight on outcomes for Māori learners and ensure that our system recognises the aspirations of parents and whānau for their tamariki.

A strong and effective system

We assess the effectiveness of existing programmes and policy settings. We contribute to the knowledge base about what works, and create insights which support innovation and improvement in teaching and learning.

Our Commitment

We work to ensure that as an organisation and a system we honour our obligations of partnership, participation and protection under te Tiriti o Waitangi.

How we deliver

Enhancing our multi-year, multi-method evaluation and research programme

Encouraging and supporting improvement in school performance

Strengthening the quality and performance of early learning services

Valuing and supporting Māori medium education

Our Values

Our work is made stronger by the way we:

- focus on the learner and learning outcomes

- embody a spirit of service, and are accountable and work with integrity

- are inclusive, committed to biculturalism and seek enrichment through diversity

- have strong partnerships with agencies and with the sector

- collaborate with national and international research and evaluation agencies

- are transparent and impartial when working with others

- deliver excellence in evaluation services built on ethical foundations

- pursue innovation and aim to add value in every context

- are committed to environmental sustainability.

He Taura Here Tangata Our Māori Strategy

Ehara taku toa I te toa takitahi. Engari, he toa takitini. My strength is not that of one, but that of many.

In April 2021, ERO’s new Māori strategy, He Taura Here Tangata: The braided threads that bind us, was launched across the organisation. It sets the course for ensuring our mahi is grounded in the ambition for equity and excellence for Māori learners, and focuses our internal capabilities on three key areas: te reo Māori, tikanga Māori and iwi Māori.

ERO first began developing He Taura Here Tangata in 2018 and following extensive consultation and review of cross-agency strategies, we’re thrilled to now have the strategy launched and underway.

Working together to enact He Taura Here Tangata

He Taura Here Tangata identifies three te ao Māori concepts. These provide ERO with a framing that supports us to better respond to the needs of the communities we serve.

Poutokomonawa – We are grounded, resilient, purposeful, resolute, and focused.

Whakawhanaungatanga – Relationships are at the heart of achieving our goals for Māori.

We build relationships based on care, trust, integrity, inclusiveness, and learner agency.

Mahi tahi – We work together to achieve a common goal and purpose through co-construction, collaboration, and collective responsibility.

Becoming a bilingual and bicultural organization

To become a bilingual and bicultural organisation, ERO is on a journey to learn and use te reo Māori and the appropriate tikanga Māori in the workplace, when we’re out in schools and early learning services, conducting research and whenever we are representing ERO.

This year, we have started with stage one — focusing on building the confidence of our staff, and ensuring people are equipped with the opportunities and support to set their personal development plans across te reo Māori, tikanga Māori and iwi Māori.

An internal staff survey to gauge current internal capabilities and confidence in using te reo Māori; understanding of obligations under te Tiriti o Waitangi; and familiarity with tikanga and te ao Māori, validated our approach and will help inform the roll-out of the strategy and professional development opportunities.

The survey showed that staff thought it worthwhile to build confidence in te ao Māori and te reo Māori. They felt that the te ao Māori perspective was relevant to their work. It was also encouraging that most participants were actively seeking out opportunities to broaden their understanding.

“This is so important for us as individuals, as an organisation and as a country.”

ERO staff member

Tā Mātau Rautaki Pasifika ERO’s Pacific Strategy 2019-22

ERO’s Pacific Strategy sets out our critical role in supporting improvement of Pacific students’ outcomes and ensuring that Pacific learners reach their potential.

This year, we continued driving success and support for Pacific learners through a range of engagement and talanoa (conversations) with Pacific education providers and agencies. Regular workshops challenged our services to provide high quality education and focus on effective strategies and practices.

By focusing on improved quality of early childhood provision, we promote culturally responsive practices that enable Pacific learners to thrive. Our reviews of schools have emphasised stronger educational pathways so that Pacific learners can achieve and succeed right through to adulthood.

To further our goals of evaluating education provision in Pacific medium across Aotearoa, we have started working towards a key initiative — Pacific Bilingual Quality Education Framework. We will be developing systems to collect and analyse information to help us review our processes. This will inform the development of a framework for evaluating the provision of Pacific bilingual education.

Another key feature has been to support work in the High Priority Schools programme that promotes increased success for their Pacific students.

To increase accessibility of information for our Pacific communities, we are translating Te Ara Poutama – indicators of quality for early childhood education: what matters most, into the Samoan and Tongan languages.

We have ‘Pacific Champions’ working across ERO to help promote a stronger focus on Pacific learners. Moana Pasifika | Pacific Review and Evaluation continues to provide professional learning to build our organisation’s cultural awareness and responsiveness - through presentations and workshops at national forums and regional hui.

Strengthening the education systems of our Pacific regional neighbours

Initiatives are well underway to re-engage with current partners in the Pacific region – Cook Islands, Niue and Tokelau. In preparation for our work in Tokelau, we have held inter-agency meetings, including the Ministry of Education, Te Kura, New Zealand Qualifications Authority (NZQA), and the Teaching Council.

Ā Mātau Tutukihanga Our performance 2020/21

Our approach in 2020/21 reflects the significant impacts that COVID-19 had on the delivery of the first year’s 2020-2024 Strategic Intentions as set out in ERO’s strategic framework (page 8).

What we aimed to achieve

Enhancing our multi-year, multi- method evaluation and research programme

Strengthening the quality and performance of early learning services

Encouraging and supporting improvement in school performance

Valuing and supporting Māori medium education through partnerships and innovation

Growing New Zealand’s knowledge base in education

Enhancing our multi-year, multi-method evaluation and research programme

The aim of our research was to provide a stronger evidence base to promote quality teaching practices and to inform the decisions of policy makers and leaders.

To support the strategic goal of an enhanced research and evaluation programme and to better understand the performance of the education system in New Zealand for all learners, ERO established Te Ihuwaka | Education Evaluation Centre and Te Pou Mataaho | Evaluation and Research Māori.

What follows are the key contributions to our knowledge base over the past year.

Te Pou Mataaho | Evaluation and Research Māori areas of research

- Te Muka Here Tangata: The strand that binds people

- Te Kura Huanui: The treasures of successful pathways

- Te Kahu Whakahaumaru - Te Ao Māori COVID-19

- Nihinihi whenua - Valuing te reo Māori: Student and whānau aspirations

Te Ihuwaka | Education Evaluation Centre areas of research

- COVID-19: Impact on schools and early childhood services - Interim Report

- Learning in a COVID-19 World: The Impact of COVID-19 on Schools

- Learning in a COVID-19 World: The Impact of COVID-19 on Early Childhood Education

- Learning in a COVID-19 World: Supporting Secondary School Engagement

- Shining a Light on Science: Good Practice in Early Childhood Services

- Science in the Early Years: Early Childhood and Years 1-4

- Growing Curiosity Teaching Strategies to Engage Years 5 to 11 Students in Science

- Exploring Collaboration in Action: Kahukura Community of Practice

- Learning in residential care: ‘They knew I wanted to learn’

The education system

ERO’s work shines a light on the performance of the education system at school and system level. During the year, ERO started work on a multi-year research project in partnership with others across education agencies.

The Education System Review provides an opportunity to have an enduring evidence base that is coordinated across agencies and draws on both domestic and international data.

Te Muka Here Tangata: The strand that binds people

In April 2021 we launched Te Muka Here Tangata to grow our evidence base on the impact of the 2020 COVID-19 Alert Level changes on Māori learners. This report is a case study of eight, low-decile English medium schools with high populations of Māori students in the Bay of Plenty and East Coast regions.

Qualitative data was collected from structured interviews carried out in each of these schools. Of the 129 learners interviewed, 65 were in rūmaki immersion Māori classes. Many leaders and teachers participated, and we also heard from 49 whānau members.

The research, carried out by Te Uepū ā-Motu and Te Pou Mataaho, supports work that ERO conducted in partnership with the Māori medium sector for Te Kahu Whakahaumaru, released in January 2021, and the Learning in a COVID-19 World series (page 18).

ERO’s research highlights the challenges, successes, valuable innovations, and opportunities for change which emerged in response to the lockdown events of 2020.

What we found

- Whānau wellbeing and learner engagement and progress were well supported during COVID-19 Alert Levels 4 to 2, despite schools facing challenges which included: lack of resources; inadequate access to digital devices and internet connectivity; and greater financial pressure placed on whānau.

- A culture of care and moral responsibility underpinned schools’ actions. Learners and whānau were given hygiene, care and kai packs.

- Some of the schools had very strong associations with community groups, iwi and hapū, and together they were able to ensure emotional support was available and kai was provided during lockdown.

- Whānau became more involved in children’s learning and progress during lockdown.

- Schools and teachers demonstrated manaakitanga and creativity to respond to whānau and learners with additional needs.

- The health, safety and wellbeing of learners and their whānau was at the forefront of decision-making.

Te Kura Huanui: The treasures of successful pathways

This year, marked a significant milestone for ERO and the Māori medium sector with the launch of our national report Te Kura Huanui: The treasures of successful pathways. This is the first time a cohesive national report has been produced to document the common conditions for success in Māori medium education.

Developed closely with Māori medium peak bodies, Te Rūnanga Nui o Ngā Kura Kaupapa Māori, Ngā Kura ā Iwi o Aotearoa, Te Kōhanga Reo National Trust and individual Māori medium sites, it brings together a rich collection of research, footage and stories documenting the Māori medium learning pathway.

As well as significantly contributing to the evidence base and research about Māori medium pathways, it supports Māori medium education in identifying and defining their own best practice, and offers valuable insights for all educators of Māori learners.

The project involved face-to-face interviews, observations, and film footage of early founders, kaumatua, kura, raukura and manu pīrere (graduates), kaiako, kaimahi, tumuaki, whānau, hapū and iwi. Research was conducted by Māori, for Māori, with Māori and in te reo Māori, whenever possible.

The intention was to become a part of the journey provided in Māori medium education, and to identify and share those common conditions for success where Māori are happy, confident learners who display a strong sense of being Māori. Documenting these common themes through Te Kura Huanui, and the rich storytelling offered through the accompanying videos, offered a rare opportunity to share the philosophies of Māori medium education and tell the story of early founders and those who carry on their legacy.

Nihinihi Whenua – Valuing te reo Māori: Student and whānau aspirations

Released in September 2020, this report shows student and whānau perspectives on the teaching of te reo Māori in English medium schools (English medium schools teach using English as the main language).

This report follows an earlier publication, Te Tāmata Huaroa, which reviews the teaching and learning of te reo Māori in English medium schools.

Learning in a COVID-19 World

The ongoing COVID-19 pandemic has had a profound impact on all aspects of life around the world. In 2020, significant disruption to education provision occurred in New Zealand through national and local lockdowns, closure of individual schools, and from ongoing uncertainty and new requirements.

We undertook a programme of research to understand the impact COVID-19 had on students, and to capture and share successful responses by schools and early learning services to inform how we can better support students. From this work, Te Ihuwaka produced an interim findings report and three full reports, including:

- COVID-19: Impact on schools and early childhood services - Interim Report

- Learning in a COVID-19 World: The Impact of COVID-19 on Schools

- Learning in a COVID-19 World: The Impact of COVID-19 on Early Childhood Education

- Learning in a COVID-19 World: Supporting Secondary School Engagement

These reports indicate that although schools and services developed a range of positive solutions during the pandemic, the impacts of COVID-19 on learners will continue to be felt in the coming year.

The research showed that schools in Auckland and those serving the lowest socio-economic areas were hit hardest by the impacts of COVID-19 and are likely to face the greatest challenges going forward. Nearly 80 percent of low decile schools told us they were concerned about student achievement, with only a third of these schools confident that their students would catch up. Early childhood education services noted concerns about attendance and possible delays in children starting school as ongoing challenges.

The reports also showed that there was a positive increase in the use of digital technology. Teachers, schools and services indicated that they intend to continue to use digital technology in their curriculum.

To support the education sector on the back of these reports, Te Ihuwaka produced short guides for teachers, kaiako, leaders and parents – with key information for each group on what to think about when supporting students in 2021.

With secondary students being most at risk of disengaging from learning, we also produced an evidence-based report on supporting secondary school engagement. This report drew on evidence from a range of sources to explain strategies for supporting secondary students who present with wellbeing concerns or show signs of disengagement during the COVID-19 pandemic.

Science teaching in New Zealand

Recent national reports show that New Zealand students are not achieving as well in science as international students. To better understand how science teaching, learning and outcomes can be strengthened and improved, we published three reports:

- Shining a Light on Science: Good Practice in Early Childhood Services

- Science in the Early Years: Early Childhood and Years 1-4

- Growing Curiosity Teaching Strategies to Engage Years 5 - 11 Students in Science

These reports identify where schools and early learning services are doing well and highlight how they could increase the impact of their science teaching and learning.

In the early years, we found elements of good practice, such as kaiako and teachers providing interesting contexts for children’s learning.

We also found areas that could be strengthened, such as better planning for children’s learning and progress in science, rather than discrete science activities.

In primary schools, we found that a planned approach to strengthen students’ engagement in science; increasing the breadth of science experiences offered; targeting external and in- school professional learning and development; and using a variety of information for planning and evaluation were key influences that contributed to improved outcomes in science.

In secondary schools, we recommended reviewing science programmes across all year levels; refocusing on the Nature of Science; carefully structuring the development of skills and knowledge; and responding to learners’ interests and strengths to improve science teaching and learning.

To support the education sector on the back of these reports, Te Ihuwaka produced short guides for key audiences and ran webinars for science educators.

Kahukura Community of Practice

This year, ERO released two new reports as part of its ongoing Collaboration in Action series – a series of reports that provide insights to encourage and support collective improvement between schools. Collaboration between schools and focusing on improving teaching and learning outcomes has a positive impact on raising student, school, and system performance.

The report, Exploring Collaboration in Action: Kahukura Community of Practice, explores the unique model established by Kahukura, a community of practice in Christchurch. ERO found that the Kahukura model supports collective improvement using focus areas, adds value through networking and creation of knowledge, and is likely to be sustainable into the future.

While collaboration through a community of practice is not a ‘one size fits all’ model, there are lessons from Kahukura for other schools to consider when collaborating. The report documents these lessons, such as clear decision- making processes and distributed leadership with role clarity being important.

Learning in residential care: ‘They knew I wanted to learn’

During the year, we reviewed how well education is going for children and young people placed in Oranga Tamariki residential care. We found that the education these vulnerable students received is not good enough. It was too variable, dependent on which residence they were placed in, and a quarter of sites were not providing students with quality education.

Students are too often studying subjects with limited pathways and while there is a commitment to improving outcomes for Māori, culturally responsive practice is variable.

In addition to evaluating the provision of education, the Learning in residential care: ‘They knew I wanted to learn’ report makes recommendations to significantly improve the quality of education and outcomes for these students. A key recommendation is to build a clear picture of what good education in residences looks like, something that is currently lacking, and deliver this consistently across sites.

Strengthening the quality and performance of early learning services

A new approach to monitoring and assurance in early learning services

To strengthen early learning services, we are repositioning the way we work with the early learning sector, so it more strongly contributes to improvement in learning conditions and outcomes.

For English medium services, we have developed a new indicators framework, which is underpinned by current research on quality early learning provision. This framework provides a clear statement about what good quality looks like, and ERO’s expectations of services.

The indicators focus on evaluation and improvement and are complemented through a new approach to reviews.

In 2019 we introduced the Akanuku assurance approach to our Early Learning Service Reviews. This approach focuses on ensuring that the foundations for the safe operation of a service are in place, and that services are meeting their legislative and regulatory obligations and associated licensing criteria. It is a deliberate approach to strengthening assurance of early learning services.

From 2020, we began the implementation of the Akarangi quality evaluations. Our new Akarangi approach assesses whether a service has the learning and organisational conditions to support excellent and equitable outcomes for all learners.

There is a strong evidence base to support this new approach. Over time, ERO was finding that new services were not able to maintain their responsibilities under regulatory standards and licensing criteria. ERO has written to all services to ensure that they are cognisant of their responsibilities and their requirements to have robust systems and processes in place.

In adopting our new approach, we are requiring early learning services to establish, as part of their response to a review, a quality improvement plan.

Recent changes brought in through the Education and Training Act 2020 also allow ERO to take a more active role in the review of home-based early learning services.

Taking a risk-based approach in response to the disruption from COVID-19

The temporary closure of many early learning services due to COVID-19, along with the added restrictions from Alert Level 2, has limited ERO’s ability to undertake many of its scheduled reviews in 2020/21. As a consequence, we have prioritised reviews of new services, those who have changed their licensing status from Provisional to Full Licence status, standalone services and those who have been on a long-term review cycle.

Our intention is to evaluate all licenced services every three years.

In summary, our progress towards our intentions during 2020/21:

- We published reports for 772 early learning services (this includes Akarangi Quality Review reports, Akanuku Assurance reports, and Māori medium reports)

- We engaged with 90 Māori medium services using our te ao Māori evaluation frameworks and published 90 reports

- We issued 219 early learning services compliance letters identifying the need for prompt improvements to learning conditions. This represents 30 percent of services which were reviewed during the financial year

- We continued work on finalising our approach to umbrella organisations.

Providing parents and stakeholders with better access to information on quality

Our new framework, Ngā Ara Whai Hua: Quality Framework for Evaluation and Improvement in Early Childhood Services was released in early 2020. This year we developed a suite of supporting resources for parents and other stakeholders. They are:

- Te Ara Poutama – Indicators of quality for early childhood education: what matters most is at the core of the quality framework. ERO expects all early childhood services to use the indicators in their internal evaluation and planning for improvement. They form the basis of our external evaluations of early childhood services.

- Ngā Rāpupuku Indicators Poster outlines the conditions that support quality early childhood education, along with the valued learning outcomes. It presents the indicators in relation to learning and organisational conditions and includes questions ERO and services ask when working with the indicators.

- Akarangi Quality Evaluation Judgement Rubric is used in conjunction with the indicators. It supports early childhood services to make judgements about the extent to which they have the learning and organisational conditions to support equitable and excellent outcomes for all learners.

A further three resources to support services’ internal evaluation for improvement and help parents and whānau to know what to expect from their child’s early childhood service have been developed:

- Ngā Aronga Whai Hua – Improving quality in early childhood education through effective internal and external evaluation

- Piki Ake, Kake Ake – Striving for equity and excellence. A guide to quality improvement planning for early childhood services

- What matters most for your child and their learning in an early childhood service

Identifying and ensuring action for those services that are not providing high-quality learning

ERO’s powers in the Education and Training Act 2020 are to ‘review’ and ‘report’ to the Minister of Education and to the wider community on services that are not providing high-quality learning.

What we found from our surveys of early learning services in 2020/21

We have received 84 responses to our survey of early learning services after completion of their Akarangi Quality Review in 2020/21.

This represents 50 percent of those services where we completed Akarangi | Quality Reviews. Of these:

- 79 percent said they had become more intentional about what they can do to improve learning for children in relation to the outcomes in Te Whāriki

- 82 percent said the evaluation helped to develop the service’s internal evaluation capability or capacity

- 80 percent said the evaluation would help to engage the service’s team in quality improvement planning

- 71 percent said it would help enhance the learning conditions in their service

- 58 percent said it would help to improve the organisational conditions in their service.

Driving improvement in New Zealand schools

Encouraging and supporting improvement in school performance

A new approach to school review

ERO’s new approach to working in schools aims to have a direct impact on the overall quality and performance of New Zealand schools and through this lift outcomes, particularly for those learners who are at risk of failing in our system. At the centre of the approach is shifting our system to one which is focused on improvement.

Given New Zealand’s highly devolved and autonomous public school system, our new approach aims to shift ERO’s proposition from merely describing the conditions that it sees in a school to one where our engagement is a catalyst for more rapid and sustained improvement.

This involves a more differentiated approach to working with schools, and one where the intensity and nature of our engagement is based on an assessment of the internal capability within a school to affect sustained improvements in outcomes for learners.

Since February/March 2020, we have been moving from the ‘one-off’ episodic review every three to five years, to establishing an ongoing relationship with schools where we work alongside them as ‘evaluation partners’. Through evaluation, we assist them in identifying critical areas for improvement, goal and target setting, and actions required to give effect to these. Based on a strong body of evidence at the heart of this ‘inside-out’ transformation, we are supporting schools to better understand and drive improvement over time.

“A promising start and a good concept. Finally, I will be able to tell my school’s story in full.”

feedback from participating school

The new approach aims to complement a school’s own internal evaluation, strategic and annual planning and reporting cycle, and to strengthen their own engagement with and accountability to whānau and communities. In highly capable schools, our role is to provide access to tools which strengthen a school’s own self-assessment and to provide advice around monitoring and assessing the impact of their own improvement initiatives.

As part of the approach, we will encourage schools to share the interactions they have with ERO with their whānau and communities.

“Collaboration, differentiation and linking everything to our strategic goals is pure genius.”

Feedback from participating school

“A new approach to evaluation and building relationships over time that is school-led will prove beneficial in improving outcomes.”

Feedback from participating school

While our approach is focused on lifting performance and addressing equity concerns, this bespoke model is more responsive to each school’s context and needs. At its heart is building leadership capability in school improvement and evaluation, and through this ensuring that schools focus on what matters most for learners.

ERO will report publicly every three years on a school’s progress in its improvement journey, and their progress towards excellence and equity in learners outcomes. Where statutory intervention may be required, ERO will make recommendations to the Secretary or Minister of Education.

Schools are being brought into the new approach progressively through 2021 and 2022. During the 2020/21 year, 630 schools (nearly 30 percent of all schools) had joined the new model.

A greater emphasis on those schools with the greatest needs

Our new approach, in part, builds off our successful Turn Around Schools pilot which has operated over the past three years. In that pilot ERO worked in partnership with the Ministry of Education, the New Zealand School Trustees Association, and a small group of schools with challenging needs. Using in-depth diagnoses and informed by an extensive evidence base relating to school improvement, our ‘Turn Around Schools’ approach has looked at establishing a sequenced set of improvement steps. Progressing these has been supported through brokering access to appropriate, timely support focused on building leadership capability and the quality of teaching and learning.

Our new approach aims to embed these lessons into how we will work in an ongoing way with the eight to 10 percent of schools across New Zealand who have the most challenging needs.

Supporting system leadership and a more connected system

Our Leadership Partners Programme is a joint initiative with key sector groups in which school leaders join ERO in our school evaluation for improvement process.

Leadership partners (LPs) are selected based on demonstrated leadership of their school. They undergo extensive training in the processes of educational evaluation and improvement, and then work alongside our evaluation partners with one or more schools to support them in their improvement journey. LPs play a valuable role, bringing diverse expertise to the process and allowing us and the schools they work with to benefit from the valuable insights and knowledge of current practitioners. LPs are now working alongside our evaluation partners in our new evaluation approach. The intention of this programme is also aimed at growing and strengthening evaluative capacity and capability across the sector providing LPs with an opportunity to learn from and give back to the sector.

In addition to support from LPs, our methodology involves us identifying skills and expertise of other partners at various stages of the evaluation/improvement journey. This includes putting schools in touch with others, including the Ministry of Education, who can advise and support improvement initiatives which meet schools’ needs. Over time, this will result in more targeted government investment to support schools, ensuring more effective implementation and bedding in of change initiatives.

“[The ERO induction process] ...was some of the best professional learning I have ever done.”

feedback from participating teacher

In summary, during 2020/21:

- We completed 171 reviews of state and state- integrated schools and kura (including 33 Māori medium reports), and published the review reports

- We completed 35 reviews of private schools including their satellites

- We engaged 630 schools in our new ‘Schools: Evaluation for Improvement’ approach with 75 of these making up a pilot trial in 2020 and the remaining 555 coming on board in Terms 1 and 2 of the 2021 school year.

Valuing and supporting Māori education through external evaluation

Evaluation insights supporting improvement and acknowledging success

By Māori, with Māori, for Māori and in te reo Māori

ERO’s evaluation, research, and review approaches within and across Māori medium settings are underpinned by te ao Māori principles, kaupapa Māori and indigenous evaluation theory. This supports ERO and Māori medium providers to continue our joint focus on transformation through improvement.

ERO’s professional evaluation relationships and co-construction, continue to contribute to strengthening evaluation capability and building capacity across Māori organisations and institutions. Māori kaitiaki, kaimahi and kai tautoko, work alongside kai arotake (review officers) to uphold philosophical underpinnings and ensure a one-size-fits-one approach. Our shared knowledge and expertise of education and evaluation supports us to gather evaluation insights that are valid and valued.

COVID-19 required a different way of working to ensure ERO and peak bodies were responsive and relevant. This led to incorporating online working with focused onsite visits. We worked with the National Te Kōhanga Reo Trust (NTKRT), Te Runanganui o Ngā Kura Kaupapa Māori o Aotearoa (TRN) and Ngā Kura ā Iwi (NKaI) to prioritise areas for reviewing. These focused on te reo Māori, mātauranga Māori and te ao Māori, and included:

- those with identified needs receiving support

- those with identified needs who were making progress

- those due for review that could work in a different way.

The evaluation insights from this work acknowledged the support provided, the progress and the improvements made to areas identified in previous ERO reports. We were able to share our findings about the resilience of professionals, mokopuna and tamariki, whānau, hapū and iwi during and post COVID-19.

We also know from this work that the physical, social, emotional, and intellectual needs of learners were at the forefront for kōhanga, puna immersion centres, Te Aho Matua Kura Kaupapa Māori, Ngā Kura a Iwi Kura and kura Motuhake.

Titiro whakamuri, haere whakamua

ERO, NTKRT, TRN and NKaI are proud of the collaboration over the years in the development and use of our indigenous evaluation approaches and indicators. We have recently begun a strategic piece of work to consider how we work, what we do and what next given all that we know. Our work will continue to ensure that:

- every kōhanga reo, puna reo, kura, wharekura and kōhanga reo focuses on positive outcomes for their learners and has established an improvement culture

- every mokopuna, tamariki, uri and raukura and manu pīrere are supported to enjoy and achieve their educational success as Māori

- we implement Māori methodologies where whānau, hapū and iwi influence is at the forefront of the work we do

- we support improvement in Māori medium settings through effective partnerships and innovation with peak bodies, their whānau, hapū and iwi

- we continue developing valuable and valued insights into the provision of education through the medium of te reo Māori.

ERO’s capability and capacity

Becoming a bilingual and bicultural organisation

Our Māori Strategy, He Taura Here Tangata, sets out three key areas for our internal capabilities across: te reo Māori, tikanga Māori and iwi Māori. This year, we have started with stage one — focusing on building the confidence of our staff, and ensuring people are equipped with the opportunities and support to set their personal development plans. Read more about He Taura Here Tangata on page 10.

Enhancing our frameworks, methodologies and tools

ERO has completed significant development work associated with new frameworks and methodologies for evaluation in both early childhood education and schooling.

Ngā Ara Whai Hua: Quality Framework for Evaluation and Improvement in Early Childhood Services includes a suite of supporting resources to provide parents and other stakeholders with information on quality improvement in early learning services.

ERO has strengthened the improvement orientation of its approach to evaluation that better supports the development of schools’ internal evaluation capacity for continuous improvement.

We reviewed existing resources that support evaluation capability and capacity building and developed a new methodological framework and resources.

ERO’s new Leadership Partners Programme initiative provides opportunities to develop evaluation and improvement expertise across the sector that schools will be able to draw on.

Changes in the operating model and resourcing of evaluation in the schooling context are designed to support the shift to the ‘Schools: Evaluation for Improvement’ approach.

Developing new skills to make best use of our capabilities

Professional learning and development provision

Professional practice leaders have led ongoing induction programmes as new evaluators join ERO. We support our evaluators to develop new skills with a range of national and regional professional learning opportunities and workshops to enable them to engage with, and use, new methodologies in both ECE and schooling contexts. ERO has supported two groups of evaluators to participate in the Poutama Pounamu programme and provided access to a range of Māori language learning programmes.

Opportunities for post-graduate study and virtual attendance at national and international conferences and institutes have also been provided. ERO evaluators have presented keynotes and workshops at these conferences and are supported to submit and publish findings from internal research projects.

Sector engagement in ECE

To support capability building and the implementation of a new methodology in early childhood education, our sector engagement between 1 July 2020 and 30 June 2021 has been significant.

We carried out around 50 presentations, keynotes and workshops with up to 1,300 managers, leaders, kaiako and teachers across the country. This included presentations and workshops with groups of kindergarten professional leaders, head teachers and teachers; large cross-sector presentations for teachers; and Zoom presentations with early learning leaders, teachers, and professional learning and development facilitators.

Building enduring partnerships and networks

Establishing and maintaining partnerships within the sector is crucial to ERO’s future direction.

The Ministry of Education is a critical partner in our work with the sector and with the New Zealand Council for Educational Research (NZCER) in building the knowledge base to support decision-making at all levels of the system. We work equally closely with New Zealand’s Qualifications Authority (NZQA), the Teaching Council, New Zealand School Trustees Association, unions, and education sector peak bodies. Key Māori medium partners include Te Rūnanga Nui o Ngā Kura Kaupapa Māori o Aotearoa, Ngā Kura a Iwi o Aotearoa and the National Te Kōhanga Reo Trust.

Our Early Childhood External Stakeholder Group includes leaders from early childhood organisations across the country.

We have two main advisory groups focusing on our work with schools. These are our Leadership Partners Establishment Board and our Principal Advisory Group, consisting of a cross- representation of school principals in addition to our work with the peak bodies.

Our Leadership Partners Programme, where we identify talented leaders in the sector, invests in building their understanding of evaluation.

It also enables us to have a strong dialogue and ‘real world’ test for the work of ERO.

Modernising our technology systems

ERO continued the adoption of Microsoft Office 365 products in 2020/21 and had begun piloting Teams before the COVID-19 lockdown in March 2020. We have continued the development and use of this tool for collaboration within ERO and we expanded management reporting with Power BI, a business analytics service.

The next stage of this work will be the full adoption of SharePoint products including digital workspaces.

A new ERO website was launched in April 2021, and we upgraded to the new version of our finance system, allowing us to get closer to supporting government goals for e-invoicing and shorter supplier payment times.

Modernising our technology systems means an investment in systems and the tools necessary to support the security of our data.

Growing leadership in our people

ERO’s leadership strategy, Te Waka Hourua Arotake Matauranga, provides a strong foundation for leadership development.

We are providing opportunities for leadership growth and learning for everyone in ERO, in particular those coming into leadership roles. We have made good use of the Leadership Development Centre’s online New People Leader courses, and courses for aspiring leaders. We want our people to lead ERO’s ongoing transformation and more broadly contribute to the transformation of our system.

An important leadership initiative has been the provision of a comprehensive ‘Leaders as Coaches’ professional development programme for our managers in Review and Improvement Services. This programme has helped establish a coaching mindset for leaders as they lead the implementation of new approaches to evaluation and ongoing improvements in the quality and consistency of professional practice across ERO.

Health, Safety and Wellbeing

Health, safety and wellbeing information is regularly shared with all staff in our fortnightly newsletter, and is available on our intranet.

The Health and Safety governance team (including staff representatives) continues to oversee a dedicated programme of work which includes a regular staff survey.

ERO continues to maintain a strong working relationship with the Public Service Association (PSA) via a regular schedule of meetings at both a national and regional level. A new Working Relationship Agreement was finalised during the 2020/21 year and together with the Health and Safety Agreement, signed in 2020, form the foundation for the operation of the relationship.

The ERO/PSA Collective Employment Agreement (CEA) expires in June 2022. During the 2020 financial year the focus of the relationship was to review the operation of the CEA.

Diversity and inclusion

During the last 12 months, ERO has continued to work towards the Papa Pounamu work programme established by the Public Service Commission.

Papa Pounamu brings together diversity and inclusion practices across the Public Service and supports Public Sector chief executives to meet their diversity and inclusion obligations and goals.

During the year, we have made progress in the following areas: addressing bias in our recruitment processes and ensuring we use gender-neutral language; introducing inclusive leadership training; providing tools and resources to help people managers build relationships and foster inclusivity.

We are also in the early stages of forming a rainbow network, which will add to our three established employee-led networks – Fono Pasifika, Te Uepu, and the Women’s network.

Over the past 12 months we have continued to work to close gender pay gaps (currently 10 percent at June 2021).

We are working with staff and their representatives to develop the next plan, which will include a focus on ethnic pay gaps and the operation of flexible work practices.

Reducing our environmental footprint

During the year we continued efforts to reduce ERO’s carbon footprint in line with the commitment for the public service to be carbon-neutral by 2025. We have made progress to be ready to start measuring emissions, and to have verified reporting publicly available from July 2021.

We have worked with Toitū Envirocare to establish our emission position as well as look at efforts to reduce or offset emissions going forward.

The verified results for 2020/21 show that air travel accounts for 73.8 percent of ERO’s total emissions, followed by motor vehicles at 14.02 percent. We switched our vehicle fleet over the last two financial years from petrol to hybrid models and this is reflected by the relative low level of emissions from this source.

While our review teams are required to travel widely, we are reducing travel-related emissions further by increasing the use of technology for our work, including using more video conferencing for meetings.

Ngā Pūrongo Pūtea, Ngā Tutukihanga Ratonga Hoki | Financial Statements and Service Performance

Statement of Responsibility

I am responsible, as Chief Executive of the Education Review Office (ERO), for:

- the preparation of ERO’s financial statements, and statements of expenses and capital expenditure, and for the judgements expressed in them;

- having in place a system of internal control designed to provide reasonable assurance as to the integrity and reliability of financial reporting;

- ensuring that end-of-year performance information on the appropriation administered by ERO is provided in accordance with section 19A to 19C of the Public Finance Act 1989 included in this annual report; and

- the accuracy of any end-of-year performance information prepared by ERO included in this annual report.

In my opinion:

- The annual report fairly reflects the operations, progress, and the organisational health and capability of ERO

- the financial statements fairly reflect the financial position of ERO as at 30 June 2021 and its operations, progress and the organisational health for the year ended on that date; and

- the forecast financial statements fairly reflect the forecast financial position of ERO as at 30 June 2022 and its operations, progress and the organisational health for the year ending on that date.

Nicholas Pole

Te Tumu Whakarae mō te Arotake Mātauranga Chief Executive and Chief Review Officer

30 September 2021

Independent Auditor’s Report

To the readers of Education Review Office’s annual report for the year ended 30 June 2021

The Auditor-General is the auditor of Education Review Office (the Department). The Auditor-General has appointed me, Stephen Usher, using the staff and resources of Audit New Zealand, to carry out, on his behalf, the audit of:

- the financial statements of the Department on pages 41 to 61, that comprise the statement of financial position, statement of commitments, statement of contingent liabilities and contingent assets as at 30 June 2021, the statement of comprehensive revenue and expense, statement of changes in equity, and statement of cash flows for the year ended on that date and the notes to the financial statements that include accounting policies and other explanatory information;

- the performance information prepared by the Department for the year ended 30 June 2021 on pages 15 to 27 and 38 to 40; and

- the statements of expenses and capital expenditure of the Department for the year ended 30 June 2021 on page 62.

Opinion

In our opinion:

- the financial statements of the Department on pages 41 to 61:

- present fairly, in all material respects:

- its financial position as at 30 June 2021; and

- its financial performance and cash flows for the year ended on that date; and

- comply with generally accepted accounting practice in New Zealand in accordance with Public Benefit Entity Reporting Standards;

- present fairly, in all material respects:

- the performance information of the Department on pages 15 to 27 and 38 to 40:

- presents fairly, in all material respects, for the year ended 30 June 2021:

- what has been achieved with the appropriation; and

- the actual expenses or capital expenditure incurred compared with the appropriated or forecast expenses or capital expenditure; and

- complies with generally accepted accounting practice in New Zealand; and

- presents fairly, in all material respects, for the year ended 30 June 2021:

- the statements of expenses and capital expenditure of the Department on page 61 are presented fairly, in all material respects, in accordance with the requirements of section 45A of the Public Finance Act 1989.

Our audit was completed on 30 September 2021. This is the date at which our opinion is expressed.

The basis for our opinion is explained below. In addition, we outline the responsibilities of the Chief Executive and our responsibilities relating to the information to be audited, we comment on other information, and we explain our independence.

Basis for our opinion

We carried out our audit in accordance with the Auditor-General’s Auditing Standards, which incorporate the Professional and Ethical Standards and the International Standards on Auditing (New Zealand) issued by the New Zealand Auditing and Assurance Standards Board. Our responsibilities under those standards are further described in the Responsibilities of the auditor section of our report.

We have fulfilled our responsibilities in accordance with the Auditor-General’s Auditing Standards.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Responsibilities of the Chief Executive for the information to be audited

The Chief Executive is responsible on behalf of the Department for preparing:

- financial statements that present fairly the Department’s financial position, financial performance, and its cash flows, and that comply with generally accepted accounting practice in New Zealand;

- performance information that presents fairly what has been achieved with each appropriation, the expenditure incurred as compared with expenditure expected to be incurred, and that complies with generally accepted accounting practice in New Zealand; and

- statements of expenses and capital expenditure of the Department, that are presented fairly, in accordance with the requirements of the Public Finance Act 1989.

The Chief Executive is responsible for such internal control as is determined is necessary to enable the preparation of the information to be audited that is free from material misstatement, whether due to fraud or error.

In preparing the information to be audited, the Chief Executive is responsible on behalf of the Department for assessing the Department’s ability to continue as a going concern. The Chief Executive is also responsible for disclosing, as applicable, matters related to going concern and using the going concern basis of accounting, unless there is an intention to merge or to terminate the activities of the Department, or there is no realistic alternative but to do so.

The Chief Executive’s responsibilities arise from the Public Finance Act 1989.

Responsibilities of the auditor for the information to be audited

Our objectives are to obtain reasonable assurance about whether the information we audited, as a whole, is free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion.

Reasonable assurance is a high level of assurance, but is not a guarantee that an audit carried out in accordance with the Auditor- General’s Auditing Standards will always detect a material misstatement when it exists.

Misstatements are differences or omissions of amounts or disclosures, and can arise from fraud or error. Misstatements are considered material if, individually or in the aggregate, they could reasonably be expected to influence the decisions of readers, taken on the basis of the information we audited.

For the budget information reported in the information we audited, our procedures were limited to checking that the information agreed to the Department’s Estimates of Appropriation 2020/21 and Supplementary Estimates of Appropriation 2020/21 for Vote Education Review Office. We did not evaluate the security and controls over the electronic publication of the information we audited.

As part of an audit in accordance with the Auditor-General’s Auditing Standards, we exercise professional judgement and maintain professional scepticism throughout the audit. Also:

- We identify and assess the risks of material misstatement of the information we audited, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

- We obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Department’s internal control.

- We evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by the Chief Executive.

- We evaluate the appropriateness of the reported performance information within the Department’s framework for reporting its performance.

- We conclude on the appropriateness of the use of the going concern basis of accounting by the Chief Executive and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Department’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the information we audited or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause the Department to cease to continue as a going concern.

- We evaluate the overall presentation, structure and content of the information we audited, including the disclosures, and whether the information we audited represents the underlying transactions and events in a manner that achieves fair presentation.

We communicate with the Chief Executive regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

Our responsibilities arise from the Public Audit Act 2001.

Other information

The Chief Executive is responsible for the other information. The other information comprises the information included on pages 2 to 14 and 28 to 32, but does not include the information we audited, and our auditor’s report thereon.

Our opinion on the information we audited does not cover the other information and we do not express any form of audit opinion or assurance conclusion thereon.

Our responsibility is to read the other information. In doing so, we consider whether the other information is materially inconsistent with the information we audited or our knowledge obtained in the audit, or otherwise appears to be materially misstated. If, based on our work, we conclude that there is a material misstatement of this other information, we are required to report that fact. We have nothing to report in this regard.

Independence

We are independent of the Department in accordance with the independence requirements of the Auditor-General’s

Auditing Standards, which incorporate the independence requirements of Professional and Ethical Standard 1: International Code of Ethics for Assurance Practitioners issued by the New Zealand Auditing and Assurance Standards Board.

Other than in our capacity as auditor, we have no relationship with, or interests, in the Department.

Stephen Usher

Audit New Zealand

On behalf of the Auditor-General Wellington, New Zealand

Service Performance for the year ended 30 June 2021

The following service performance information outlines the actual performance measured against quality and quantity specifications and cost. The results for the year ended 30 June 2021 are reported against the forecast information contained in the Estimates of Appropriation 2020/21 and against those as amended by the Supplementary Estimates. Explanations of major variations from the Estimates of Appropriation 2020/21 are included.

Evaluations of the Quality of Education

This appropriation is limited to evaluations of national and local education programmes and providers, and to evaluation services provided to third parties under contract.

This appropriation is intended to achieve improvements in teaching and learning practices by assisting early childhood learning services, schools and other education service providers to improve their capacity in internal evaluation, governance and leadership through ERO’s independent evaluations. It also includes influencing and informing on the development and implementation of education policy and practices through ERO’s system-wide evaluations and through the provision of other services.

Performance against appropriation

ERO used the following performance measures for Evaluations of the Quality of Education for the year ended 30 June 2021.

Monitor and Evaluate

|

Actual 2019/20 |

Evaluations of the Quality of Education |

Note |

Actual 2020/21 |

Budget 2020/21 |

|---|---|---|---|---|

|

- |

Proportion of hours of evaluation services provided to ERO's high priority providers |

1 |

59% |

New Measure for 2020/21 |

Influence

|

Actual 2019/20 |

Evaluations of the Quality of Education

|

Note |

Actual 2020/21 |

Budget 2020/21 |

|---|---|---|---|---|

|

75% |

Percentage of early childhood learning services that indicate ERO's evaluations are making a contribution to their decisions about how to improve learner outcomes |

2 |

79% |

>85% |

|

86% |

Percentage of early childhood learning service respondents that indicated their ERO evaluation had helped to identify or confirm opportunities for more effective practice and building capacity |

2 |

82% |

>80% |

|

86% |

Percentage of schools that indicated ERO's evaluations had made a contribution to their decisions about how to improve learner outcomes |

3 |

69% |

>85% |

|

91% |

Percentage of school respondents that indicated their ERO evaluation had helped to identify or confirm opportunities for more effective practice and building capacity |

3 |

71% |

>80% |

|

Not reported |

Key audiences reported that ERO’s national evaluations were informative and useful for identifying or planning improvement within the system or its component parts |

4 |

96% |

>80% |

|

- |

Proportion of early childhood learning services evaluated referred for licence review or support |

5 |

15% |